Get a great start on the New Year and help bring your bills under control with our New Year bill detox. Throughout the year, we all sign up for subscriptions we never use or forget about our monthly contracts expiring. Taking a moment to go through your bills can help you save £100s to go towards the things that really matter.

Hunt down expired contracts

From broadband to gym memberships, businesses will often lure you into contracts with amazing introductory offers, only to raise the price when you’re outside your minimum contract period. When it comes to the internet, many see their bill jump by up to 60% as soon as the initial contract ends.

Put aside an hour this month to look at all your contracts and check whether any have expired. If you are out of contract, it’s time to grab another great introductory offer from a new supplier.

Ditch the unused subscriptions

Even worse than overpaying for something every month, you might be paying for subscriptions and contracts you never use. According to NatWest, the average Brit spends £39 a month on services they’re not using. The same study found that more than a third of people check their subscriptions less than twice a year. If that’s you, make sure to spend some time in January looking through all your regular payments.

If you’re not sure whether to cancel one of your payments or not, spend a month tracking every time you use it. At the end of 30 days, look over your usage and decide if you would pay that if you weren’t a subscriber.

For example, if you have a Netflix plan for £13.99 and watched two films in a month – would you have paid £6.99 to rent each of those films? If not, cancel the plan.

NatWest’s study found 10% of people in the UK pay for a streaming service they don’t use.

Check your credit score

It’s tempting to think that keeping our credit score out of sight will mean we don’t have to deal with it, but, unfortunately, that isn’t true. Your credit score can influence your rates for loans and mortgages, and whether you get approved for things like phone plans.

Luckily, it’s free to check your credit score with the UK’s largest referencing agency, Experian. Sign up with Experian here and learn about your credit, including tips on how to boost your score instantly.

Did you know? Canopy Grow is a new service that lets you report your regular payments, including rent, to credit reference agencies like Experian.

Refresh your budget

If you’re trying to manage your money better, you’ve probably already drawn up a monthly budget for your income and outgoings. However, it’s important to regularly go back to your budget and update it.

If any of your bills and monthly subscriptions have increased since you last ran your calculations, you may have less left at the end of the month than you expect.

Keep your energy supplier up to date

Your energy bill should be based on the amount of gas and electricity you use each month. Wait too long to submit your meter readings, however, and your supplier will switch to billing you based on estimated usage. These estimations tend to be higher than the real figures, especially if you’re actively trying to reduce your energy consumption.

Submit an up-to-date meter reading to your energy supplier, and your water company if you have a water meter, and your bill will be recalculated. Even if your bill goes up – showing that you actually use more energy than average – updating your bills now will stop you from having to pay for all the extra usage at the end of your contract.

Detox your bills for 2023

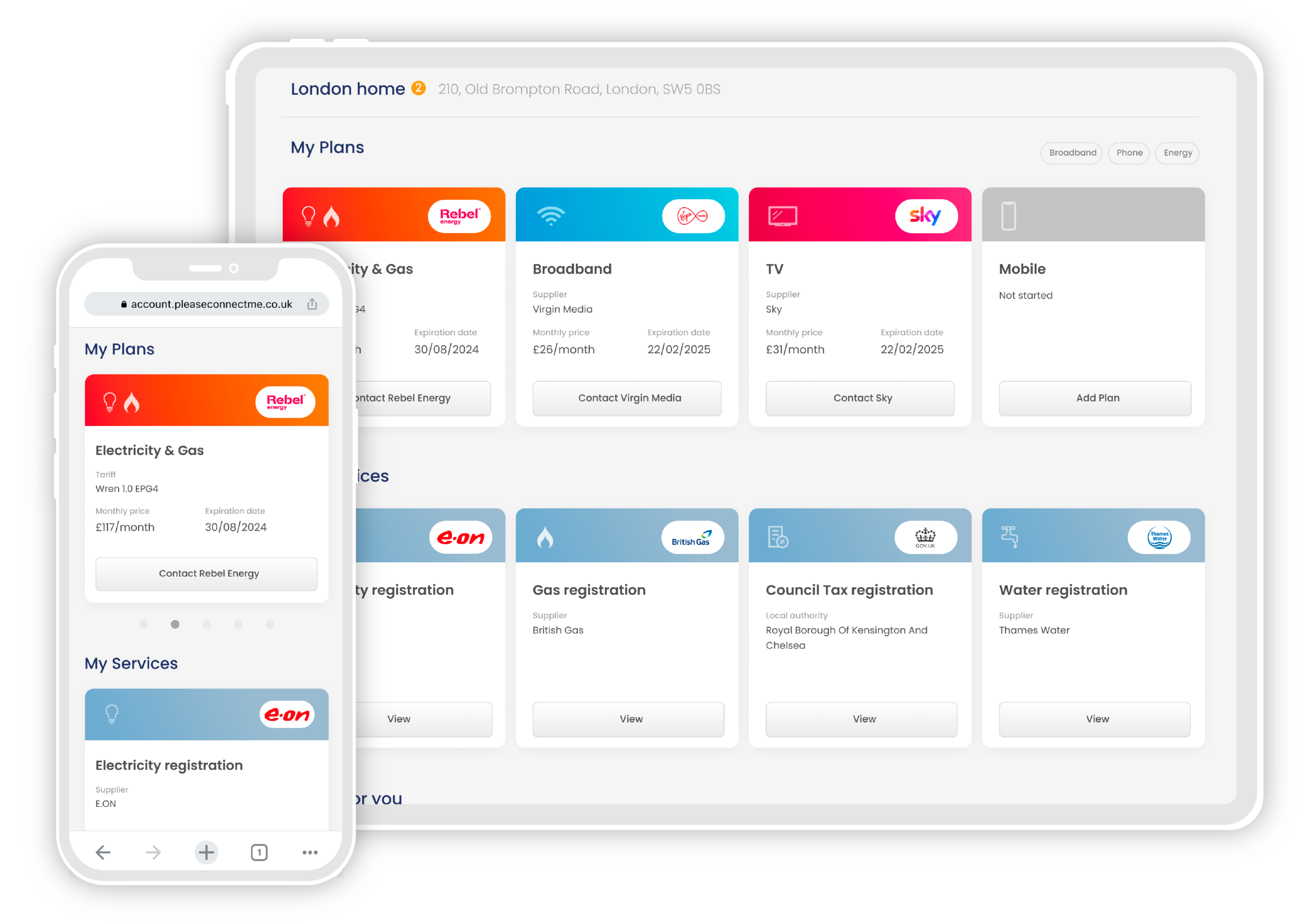

This January, start your financial year right with a bill detox. Make sure all your contracts are up to date, you’re not paying for a service you don’t use, and your credit, budget and bills are all working for you – then relax. Plus, if you set up your new contracts with Please Connect Me, you can rest assured that the next time your contracts are due to end you’ll get an automatic reminder before any price hikes. 2023 is the year we can all get smart about our household bills, and with Please Connect Me’s help getting the best from your utilities can be simple.

Read more about taking control of your bills: