Amid a worldwide slowdown in economic growth, professionals in the property industry have seen an almost universal decline in people looking to move. As the cost of living rises, tenants are choosing to stay put, private landlords are exiting the market and mortgage offers are evaporating, stopping property sales in their tracks. At the same time, operational costs have been rising across industries, creating a perfect storm of increased expenditure and reduced revenue.

While there are different ways to boost profitability, one solution is almost uniquely suited to the specific needs of the property sector. Generating secondary, residual or passive income through partnerships with other companies and professionals allows agents to increase the value of each client they assist without significantly adding to already heavy workloads.

Passive income and the property industry

For those who aren’t familiar, passive income, also known as passive or secondary revenue, refers to earnings generated without any active effort on your part.

Whether it’s through a referral made automatically through an API, one of your clients making a purchase through a link embedded in your website or customers using a unique discount code to place an order, these are opportunities to earn a commission on a sale while adding nothing to your daily workload.

Those working with clients as they buy, sell or rent a home and move into it are extremely well-positioned to benefit from this kind of revenue. The process of moving home, particularly across long distances or internationally, involves dozens of separate operations that need to be executed in sequence.

By building relationships with professionals covering services that your clients need but that don’t fall under your operational umbrella, you can not only help the moving process run more smoothly by recommending reliable industry experts but also improve your return on the time and effort you invest.

Passive revenue from removal services

Removal and storage are perfect examples of services that a client may ask for a recommendation on. Few people move home frequently enough to be brand loyal to one firm, and a cursory online search will reveal dozens of local options.

Partnering with removal agencies, packing supply stores and storage companies allows you to suggest a vetted option, with the relationship providing a steady source of affiliate income for your business and high-quality leads for theirs.

Pickfords Removals is one firm experienced in this kind of relationship. Pickfords works closely with partner agencies to provide promotions, joint marketing material and team training to help maximise the opportunity. Speaking about the earning potential of their partner agents, Adam Wilding said “Realistically an agent can expect to earn £1,000 a month based on just 5-7 moves, but one single branch took home £36,000 in a single year”.

Pickfords also offers commissions on their short and long-term storage products. These present an opportunity to receive ongoing monthly commissions for as long as clients keep items in storage, potentially the duration of their placement.

Deposit options for tenants, extra revenue for you

In an increasingly competitive rental market, options for tenants beyond the traditional substantial deposit or guarantor route are welcome. Flatfair allows tenants with good rental payment history to rent a property without a deposit, streamlining finding a tenancy for tenants, landlords and property agents alike.

For agents who refer clients to Flatfair, the benefit is not only offering a property to a tenant who might otherwise not have been able to take it but also receiving a referral fee. “Agents can earn, on average, £20-£30 per No Deposit sold, based on an average monthly rent of £700,” says Annalese Walmsley of Flatfair.

Capitalising on finances

Never is it more important to work with a company you trust than when it comes to financial services. For first-time mortgage applicants, getting good advice is a minefield, and a helpful recommendation from an agent can go a long way.

Savvy mortgage advisors are well aware of this and are keen to build close relationships with estate agencies and property professionals. Beyond just the opportunity for commissions, working closely with a skilled financial services agency will speed up your purchase pipeline and reduce your fall-through rate.

Cox and Flight is one such firm, with experience in high-volume partnerships that quickly convert into passive income. “In September 2021, Cox and Flight launched a partnership with a chain of estate agents. Within three months, we wrote just under £30,000 worth of business, which translated into an attractive income stream for our partner,” said partner Scot Flight.

Turning utility registrations into passive income

Generating revenue effortlessly is great – what’s even better is the chance to transform your time-consuming tasks into a source of secondary income. By doing so, you can not only add multiple passive revenue streams but also save countless hours on administrative work.

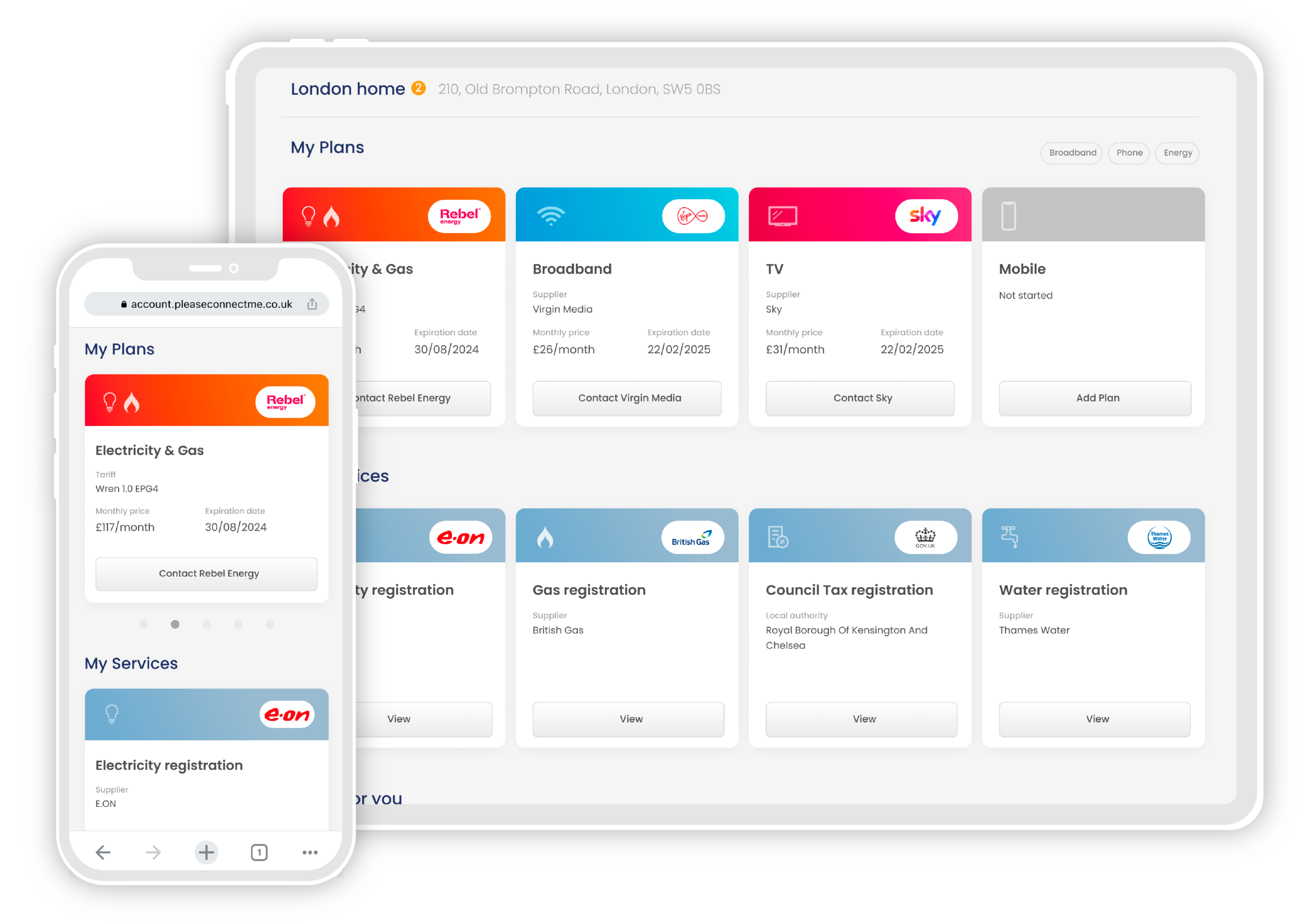

Broadband, TV, energy, mobile and other home services all represent conversion opportunities and substantial revenue. Utility Concierge Please Connect Me handles all of your utility admin while their skilled team of Connections Experts talk clients through the registration process. For any new contracts they do set up, the referring agent earns a generous commission.

CEO Dan Munro revealed “We pay an average commission of £26 for each client that sets up a paid plan with us. The potential earnings per referral are over £300, particularly as clients can renew their services when plans come to an end. We love paying out commission, with our top referrers earning in excess of £10,000 every year.”

Home maintenance and ongoing possibilities

The possibilities for secondary revenue don’t end at the end of the moving period. Managing and maintaining a home can require the help of all sorts of professionals. A relationship with handymen, cleaners, gardeners and builders local to your client base could turn into continuous revenue for years to come.

This is your chance to consider every step of your client’s move. Each of the dozens of times they’ll need help or advice is an opportunity for you to provide a connection and, potentially, generate passive income. In a perfect example of working smarter, not harder, you can increase the average value of each of your clients without adding anything to your existing workload – or even while saving yourself time on admin you used to complete yourself.

To learn more about Please Connect Me and the passive income opportunities available in the property industry book a free demo today, or reach out to us at partners@pleaseconnectme.co.uk.

Read more about property in the UK: