Whether you are heading off to university or college for the first time or switching to new accommodation, remember to register for student Council Tax exemption.

If everyone in your household is a full-time student, you are not required to pay Council Tax in the UK. However, if you haven’t registered with your local authorities they may send you bills and chase you for payment. You could end up paying too much, or having to prove your exemption in court, so registering as soon as you move in is essential.

Do I qualify for student council tax exemption?

If you are a full-time student in the UK, you do not have to pay Council Tax. Full-time means that you are studying on a course lasting at least one year for 24 weeks out of the year and requiring at least 21 hours of study a week. This covers a range of courses in the UK, and there are also exceptions for A-Level courses. You can see more details of which courses qualify here.

How do I register?

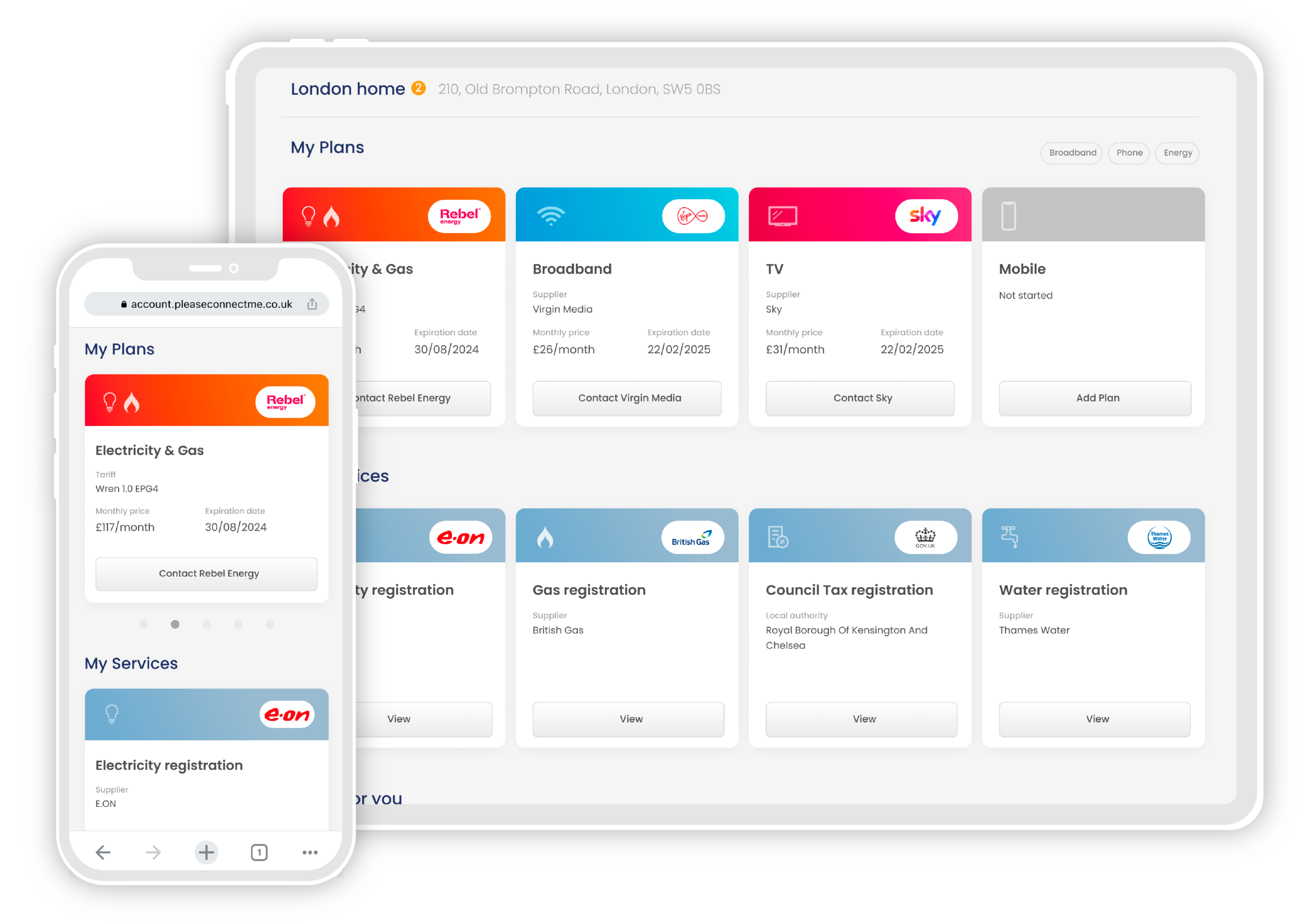

Once you have enrolled in your course you will need a student certificate for everyone in your household. You can get these from your university or college administration department. You will also need to inform your local Council of the details of everyone who’ll be occupying the property. The good news is that if you use Please Connect Me’s free utility concierge service then we handle that for you.

Once you receive your welcome letter from your council by post check the top corner of the letter for your property reference number. Then, visit your local Council’s website and look for the student tax exemption form. You’ll be asked for your property reference and to upload each student’s proof of enrolment. Once everything is submitted you can relax, notice of exemption will come by post in the next four weeks. Once you’ve got your notice you’re all set until next year.

What happens if there is a non-student in the household?

To qualify as exempt, every resident in the household must be a full-time student. If there is only one non-student occupant then you can apply for the 25% sole occupant discount – read more about other Council Tax discounts here.