If you live in the UK, the chances are that you pay Council Tax to your local authority. The amount of tax paid will vary based on the value of your property, as well as if you’re eligible for a Council Tax discount.

Most people aged 18 and over pay Council Tax in the UK. You are exempt from Council Tax if everyone in your household is a full-time student.

How is Council Tax calculated?

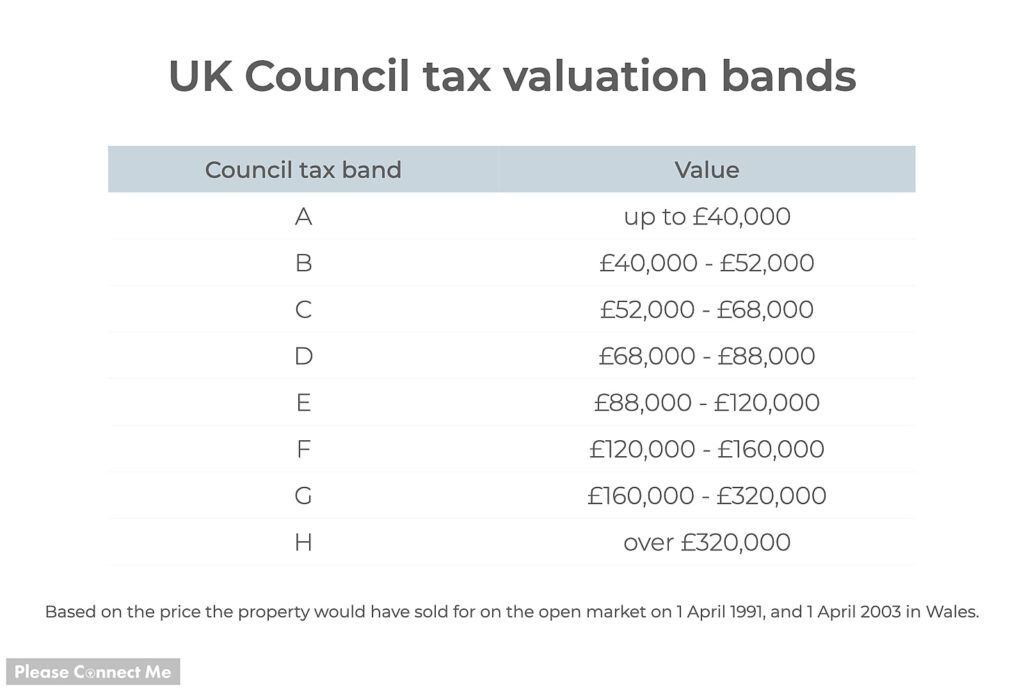

The Council Tax you’ll be charged is determined by two factors: the value of your property and the local authority you reside in. Each property in the United Kingdom is assigned a Council Tax band ranging from A to H, based on its 1991 market value.

The values for each of the 8 Council Tax bands are listed below for your reference:

The local council determines the Council Tax amount for each band as part of its budget, resulting in varying tax payments for properties within the same band due to location differences.

How do I register for Council Tax?

There are over 400 councils in the UK, which means the steps you need to take to register for Council Tax are anything but uniform. While many councils are heading online to make the process a bit easier, there are still significant discrepancies in the information they ask for – and the first challenge is actually finding out who your Council is!

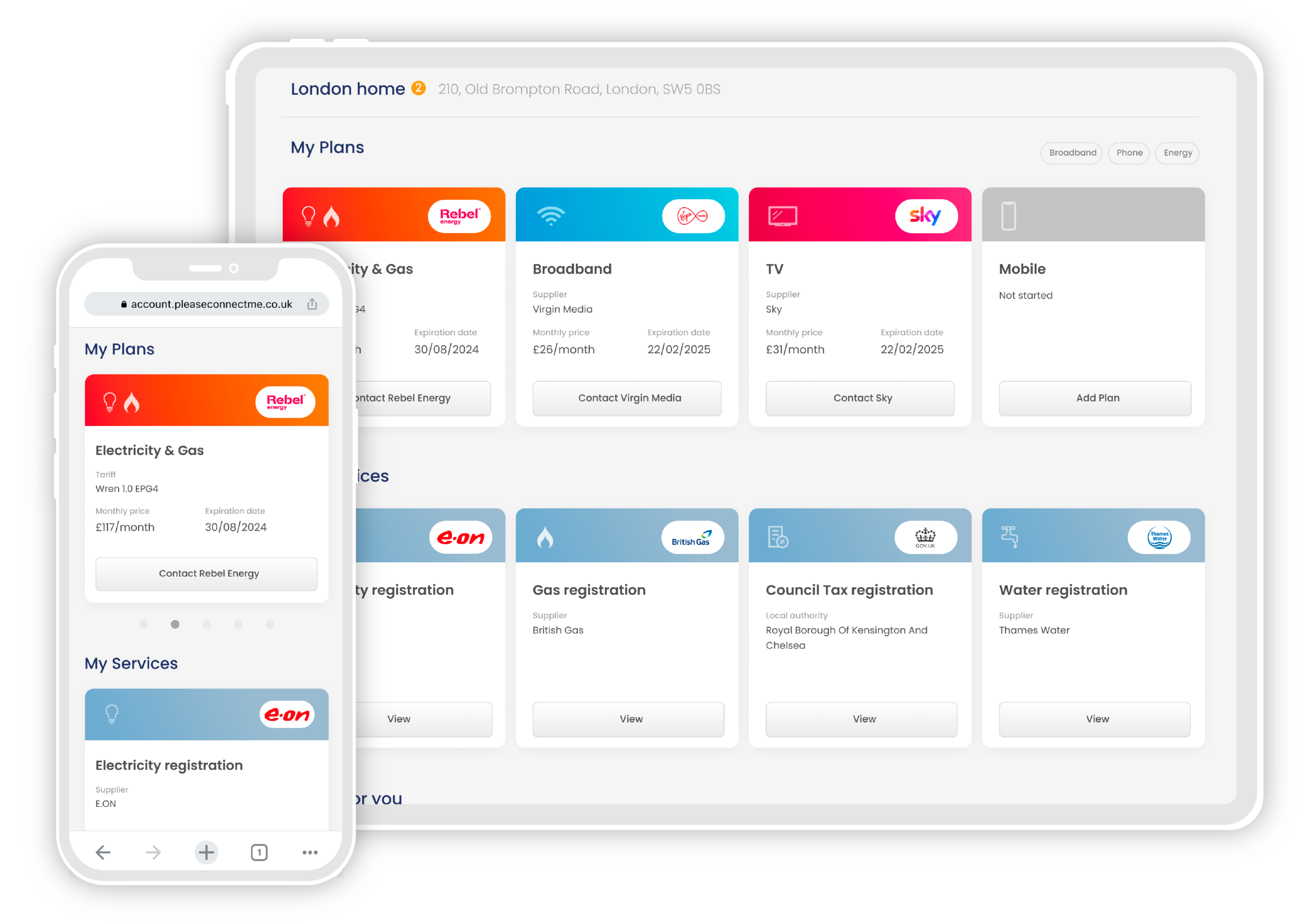

The easiest way to get your Council Tax organised is through Please Connect Me. Moving house is stressful enough as it is – so why not let us take care of this part for you? Simply sign up here, and we’ll register you to your council!

We’ll ask for the following information to help set up your Council Tax account:

- The names of everyone over the age of 18 living on the property

- Whether the property is rented or purchased

- Your move-in and tenancy start/completion date date

- The name of your letting agent (for renters) or estate agent (for buyers)

- The name of your landlord (for renters) or solicitor (for buyers)

- And your last UK address (if you have one!)

Armed with this information, Please Connect Me can register you with any council in the UK, and make sure you’re aware of any discounts, exemptions or other benefits you can take advantage of to make sure we keep your bills as low as possible.

What does Council Tax pay for?

Essential Services

Council Tax helps fund a range of essential services, such as police and fire services, leisure and recreation facilities (such as parks), libraries and education, care for elderly residents and individuals with disabilities, waste management (including collection, disposal and recycling), road maintenance (including street cleaning and lighting), and administration tasks such as updating birth, death, and marriage records. The biggest share of the tax revenue is allocated towards social care for children and vulnerable adults.

Other uses of funds

Aside from essential services, Council Tax funds may be utilized as necessary with the approval of CIPFA (Chartered Institute of Public Finance and Accountancy). Such expenditures may include support for the voluntary sector, community development, maintenance of cemeteries, aid for the homeless, and others. Reports on tax revenue usage will be periodically published by your local authority. Councils must provide public access to their detailed financial records for a minimum of 30 days each year, allowing individuals to scrutinize any expenditure they wish to investigate.

Do you know which council your address falls under? Check here