If you’ve moved home recently you may be able to reclaim Council Tax that you paid in advance. While some local authorities automatically refund you when you move, others will only repay if you reach out to them directly. Currently, there’s more than £150 million in overpayments waiting to be claimed.

We’ve put together this guide to make it easier to reclaim Council Tax overpayments. Find details on who can get Council Tax payments refunded, the best way to contact your local authority and what will happen once you reach out.

Who can reclaim Council Tax?

You can reclaim Council Tax if you overpay, either because you move home or because the value and tax band of your property changed. Most people overpay because they move home and properties changing bands is rare. If you think that this applies to you, you can read more here.

If you’ve moved from one local authority to another and you prepaid for your Council Tax, either monthly, quarterly or yearly, then there’s a chance you are owed a refund. This happens when your account is in credit, and you move before the end of the period you’ve paid for.

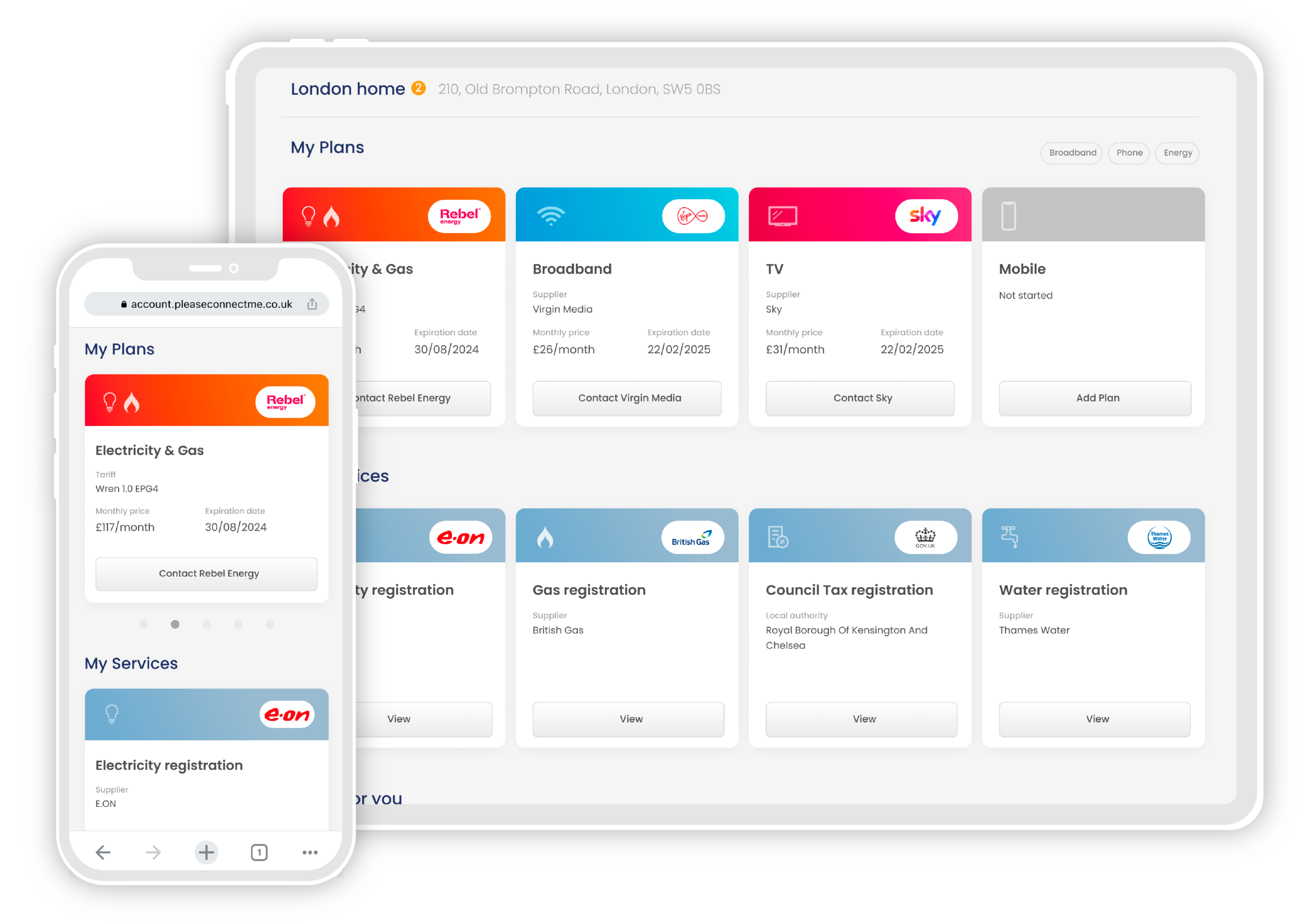

You might also overpay when you move home if you forget to cancel your standing order or direct debit payment. Use Please Connect Me’s free utility concierge service when you move to get all your accounts set up properly.

You won’t be owed any refund if you moved home but stayed within the same local authority area. Any overpayment on your previous property will have been brought forward to your new property, provided you informed your council of the move.

How to reclaim your Council Tax payments

For those who were in credit, reclaiming your Council Tax is simple. The first step is to check if your previous local council have an online reclaim form. This will be available through your local council’s website in the Council Tax section.

The form will ask for a few details, including your previous address and (usually) your Council Tax account number. Once you submit the details you’ll be told when to expect a response, and your council will reach out to arrange your refund.

If the council don’t have an online form then you will need to contact their Council Tax department directly. You can usually do this by live chat, phone or email, and you can find your local authority contact details here. The agent you speak with may ask you to fill out a form or provide details over the phone, and they’ll then assist you in arranging a refund.

Read more about Council Tax in the UK: