Expats around the world are already starting to experience the worst cost of living crisis in a generation, with budgets squeezed by tax rises and everyday purchases going up in price. The biggest change for most expats has been the increase in the energy cap on April 1, but many other price rises will add hundreds of pounds to an expat’s household spending too. The net result of rising inflation could leave thousands of expats worse off this year.

In this article, we identify the main expat expenses and offer advice on how best to manage your budget, to help you stay in control of your spending. We’ve broken down exactly what’s changing to make sure expats like you are ready to survive the cost of living crisis in 2022.

What is driving the cost of living crisis?

Expats are currently facing a cost of living crisis, which means the cost of living – composed of purchases such as energy, food and transportation – is rising faster than income. This means prices are higher across the board, rather than in just one area. The current emergency is particularly severe because it’s being driven by several different factors. Some of these factors include:

- High demand for oil and gas since the beginning of 2021 coupled with uncertainty over supply due to the Ukraine conflict. This has led to higher costs for energy companies and subsequently, their customers.

- The end of UK government support offered during the COVID-19 pandemic – such as reduced VAT rates in the hospitality sector.

- Shortages in staff across a number of sectors including hospitality and transport. This is partly due to the COVID-19 pandemic but also compounded by Brexit, which saw many foreign workers leave the country.

- Shortages of some goods due to supply chain disruptions across the globe and Brexit.

These disruptions have pushed up the UK’s rate of inflation, which is the official measure of how much the cost of everyday goods and services is rising. For example, if the rate of inflation stands at 1%, it means that prices of everyday items have risen by 1% on average. This means a bag of rice costing £1 a year ago will now cost you £1.01.

UK inflation reached a 30-year high of 6.2% in March 2022, while economists at the Bank of England warned it could hit as high as 8% in the coming weeks. On top of the already existing challenges in the global economy in the aftermath of the COVID-19 pandemic, Russia’s invasion of Ukraine sent shockwaves around the world, leading many foreign nationals to fear for their safety, while also escalating the ongoing cost of living crisis.

We will see the real scale of the cost of living crisis in a few weeks’ time. Here, we take a look at how and why the cost of living crisis may affect expats and digital nomads, and some of the ways expats can mitigate the potential issues they may face.

What has changed for expats from 1 April 2022?

On April 1, a number of changes meant the pressure on expats’ household budgets soared overnight. The UK, for instance, saw a 54% increase in home energy costs. The Bank of England responded by raising interest rates to 0.75% in March 2022, representing a seven-fold increase since December 2021. But household bills are not the only area where Brits are feeling the pinch – transport, food and fuel also soared in price, while housing costs climbed by 22.3%. Ultimately, no matter where you live, expatriates and digital nomads are likely to be feeling the effects of inflation and seeing their cost of living escalate. For many, there is a real risk of economic hardship. Here are these changes in more detail:

- Ofgem increased the Energy Price Cap by 54%, meaning a nearly £700 annual rise in bills for those who pay by direct debit. (note: The current Energy Price Cap is at £1,971 and is predicted to increase to £2,800 this October)

- There was a National Insurance increase – dubbed the health and social levy by ministers – of 10%, which experts have warned could affect the lowest earners the most.

- Council tax climbed by 3.5%, meaning those in band D could face paying an additional £2,000 annually.

- The income tax threshold was frozen, which will lead to a real-terms cut in take-home earnings for most.

- Water bills have gone up by an average 1.7%.

- Lateral flow tests will no longer be free for everyone in England, to be followed by the rest of the UK in the coming weeks.

- VAT has increased for hospitality businesses, an increase which will be passed onto customers in the form of higher price points.

The culmination of these changes is likely to result in a “living standards catastrophe”, economic researchers have warned. Let’s go through each issue expats and digital nomads in the UK might face during the cost of living crisis.

1/ Energy

Energy prices reached eye-watering levels in many nations early in the year. The cap on energy bills has risen by a record-breaking £693, which means the average household will now pay £1,971 a year for gas and electricity if they pay by direct debit. With many nations dependent on Russian gas, the cost of living has soared particularly high in European countries, with gas prices across the European Union rising 70% since the start of the Russian-Ukrainian war.

2/ Flights

A much needed getaway will cost more this year too, unfortunately. The cost of flights has taken off, rising 20.2% over the last year. Airlines are running fewer flights to help make ends meet, so flights are not only more expensive than they were this time last year, they’re harder to find too.

3/ Cars

A global semiconductor shortage has disrupted the production of new cars and pushed buyers towards the used car market, the Office for National Statistics (ONS) reported. But a lack of supply of second-hand cars has pushed prices higher.

4/ Council tax

Council tax for the average home has risen to almost £2,000, up from £1,898, as local authorities scramble to recoup income lost during the pandemic. In England, council tax bands are based on 1991 property prices, and have not been updated since.

5/ National Insurance and other rising taxes

April also marked the arrival of a series of punishing tax changes. The threshold at which employed expats in the UK start to pay National Insurance contributions will rise to £9,880 from £9,568 in April, before increasing again later in 2022.

6/ Petrol and diesel

Petrol retailers have been accused of profiteering from the cost of living crisis by raising their profit margins, even when the wholesale price of oil has fallen. The UK government has been forced to slash fuel duty by 5% per litre, after the price of petrol rose 8%, with diesel prices up by 12%.

7/ Food

The cost of the weekly food shop is increasing, with nine in 10 people reporting a higher bill at the checkout, according to the ONS. Grocery price inflation hit 5.2%, its highest level since April 2012, according to data from consultancy firm Kantar.

Ukraine and Russia both play a major role in global food markets. They are net exports of several of the leading cereal crops: wheat, maize (corn), and barley. Both are also dominant exporters of sunflower oil, one of the world’s most popular vegetable oils. Some countries – such as India – rely heavily on imports of sunflower oil for domestic food supplies.

8/ House prices

Average sale prices have risen 14.3% year-on-year, according to mortgage lender Nationwide, a pace of growth that exceeded even the highs of the stamp duty holiday rush in June last year, when growth hit 13.4%.

9/ Mortgage rates

Mortgage costs have been rapidly increasing, as lenders rushed to pass on the Bank of England’s increase in the Bank Rate. Interest rate rises will translate quickly into higher mortgage rates.

Rising mortgage costs have meant a buyer who purchases an average home could pay more than £1,000 extra per year, even if property values fell by 5% by the end of the year, according to an analysis by Hamptons estate agents.

10/ Clothing

A rapid rise in clothing prices was one of the biggest contributors to last month’s high rate of inflation across the country, official figures show.

Clothing and footwear prices increased by 8.8% in the year to February 2022, reaching its highest level since records began in 1988.

11/ Hotels and dining out

Households can also expect to pay more when eating out that the tax break pubs and restaurants enjoyed during the pandemic has come to an end.

The VAT rate charged on food, accommodation and attractions was at 12.5% in October last year. It reverted to the usual 20% from April 1, meaning businesses, which are struggling with the same energy and fuel price rises as households, will have to pass on higher costs to customers.

12/ Broadband

Telecom companies have started pushing through inflation-busting increases for broadband and mobile phone contracts. The cost of the cheapest broadband and home package has increased from £17.50 to £18, rising 3% in a year and 35% since 2016.

BT, TalkTalk, Sky and Virgin Media are all increasing prices for customers, with Virgin Media already having pushed prices up by an average £4.70 a month for broadband and TV subscribers. Meanwhile, BT will increase charges by 9.3%.

13/ Rail fares

Expats who are commuting will be hit by the biggest increase in rail fares since records began, according to official inflation projections. Fares rise in line with the Retail Prices Index, which is usually higher than the Government’s official measure of inflation.

14/ COVID-19 testing

Those who care for relatives face another new cost as the majority of free COVID-19 testing has come to an end. Carers who look after sick family members have been advised by the Government to continue testing at least twice a week, landing stretched households with huge bills.

A pack of five rapid tests costs £9.80 at Boots, so twice-weekly testing would cost around £204 per person each year, but would cost more for more frequent testing. The Government has confirmed that free tests will continue to be offered to the most vulnerable, who will be contacted directly and sent lateral flow tests to keep at home for use if they have symptoms.

15/ Netflix

Netflix has raised prices for the second time in just over a year, taking the price of its most expensive subscription to almost £16 a month.

16/ Furniture and white goods

Furniture was among the largest drivers of inflation over the last year. Prices for furniture, household equipment and maintenance rose by 9.2% in the year to February.

What is the government doing to help expats survive the cost of living crisis?

Helping families with the cost of living

As the NHS rebounds from the COVID-19 pandemic, and with the challenges facing the social care sector, the Treasury argued that it was only right that the rise in National Insurance contributions (NICs) – which will become the new Health and Social Care Levy in 2023 – stays. However, to reduce the tax burden on working people, the chancellor raised the National Insurance Primary Threshold and Lower Profits Limit, for employees and the self-employed respectively, from £9,880 to £12,570. This equalises the NICs and Income Tax threshold from July 2022. This means that individuals will be able to earn up to £12,570 a year without paying any Income Tax or NICs.

This increase will benefit almost 30 million people, with a typical employee saving more than £330 in the year from July. Around 70% of NICs payers will pay less contributions, even after accounting for the introduction of the Health and Social Care Levy. The Treasury says that around 2.2 million people will be taken out of paying Class 1 and Class 4 NICs and the Health and Social Care Levy entirely.

Create conditions by encouraging higher growth

The government considers that a new culture of enterprise is essential to driving growth through higher productivity. From April, self-employed individuals with profits between the Small Profits Threshold and Lower Profits Limit will not pay Class 2 NICs. So, lower-earning self-employed people will be able to keep more of what they earn while continuing to build up NI credits. There are now a range of measures aimed at businesses including:

- The temporary £1 million level of the Annual Investment Allowance will be extended until 31 March 2023.

- The business rates multiplier will be frozen in 2022/23.

- A new temporary 50% relief in Business Rates for eligible retail, hospitality, and leisure businesses. It means the average pub, with a rateable value of £21,000, will save £5,200. The average convenience store, with a rateable value of £28,500, will save £7,000.

- Business rates exemptions for eligible plant and machinery used in onsite renewable energy generation and storage will be brought forward to April 2022.

- From April 2023, all cloud-computing costs associated with R&D, including storage, will qualify for R&D relief.

- The Employment Allowance will increase to £5,000. This means eligible employers will be able to reduce their employer NICs bills by up to £5,000 a year, and that businesses will be able to employ four full-time employees on the National Living Wage without paying employer NICs.

- The Treasury also announced they would be consulting on a range of measures to reform business taxes and reliefs ahead of the autumn Budget.

Proceeds of growth to be shared fairly

By 2024, the OBR expects inflation to be back under control, debt to be falling sustainably, and for the economy to be growing. So, presuming the government will have met its own fiscal principles, the chancellor committed to reducing the basic rate of Income Tax from 20% to 19% from April 2024.

This is a tax cut of more than £5 billion a year and represents the first cut in the basic rate of Income Tax in 16 years. Interestingly, with more than 1,000 tax reliefs and allowances available, the government have also committed to considering tax reform “to better support a fair, efficient, simple, and sustainable tax system”.

Survival checklist

Taking some simple steps can help to reduce some of your outgoing costs and stabilise your spending. Here is our checklist of the things you can do as an expat to reduce your cost of living in 2022.

- Think about diversifying your income streams. Employers are tightening their purse strings too, so you may not see a pay increase in 2022. But you can earn extra income by taking freelance or consulting jobs to supplement your usual income.

- Inflation is a major threat to the value of savings. Savers are losing value by parking their money in cash accounts. Investing could be the solution. Keeping your money in cash or in savings accounts leads to lost value, as it can’t keep up with inflation. The economic situation isn’t likely to improve any time soon as inflation is here to stay – so if you’re hoping that the effects of inflation will only be temporary, you should think again. Before you start investing, you should carefully consider what level of risk you are prepared to take on. Ensure your investments are properly managed.

- Cut out unnecessary spending. Many expatriates are enticed by a more luxurious lifestyle while living abroad, but you may find it more economical to cut out spending on conveniences such as car leasing or sports and leisure.

- Are you helping relatives abroad? If so, you may find that pays to shop around for the best deals on money transfers.

- As Martin Lewis puts it, ‘heat the human not the home’ and try to cut down on energy usage.

- Top-up your state pension. Pension credit is a tax-free, means-tested benefit aimed at retired people on low incomes and can be worth £1,000s a year.

- Make do and mend via a Repair Cafe. If you have broken household items you are unable to repair, check for local Repair Cafes, where volunteers repair anything from clothes, toys, electricals, computers etc. It’s free, but they appreciate a donation of what you can afford. It avoids adding to landfills.

- Think about the cost of your international health insurance. You may be able to save by switching suppliers or by reducing the comprehensiveness of your plan.

- Consider taking out global income protection. This form of insurance promises to pay out up to 80% of your usual salary if you become incapacitated while living abroad and unable to work.

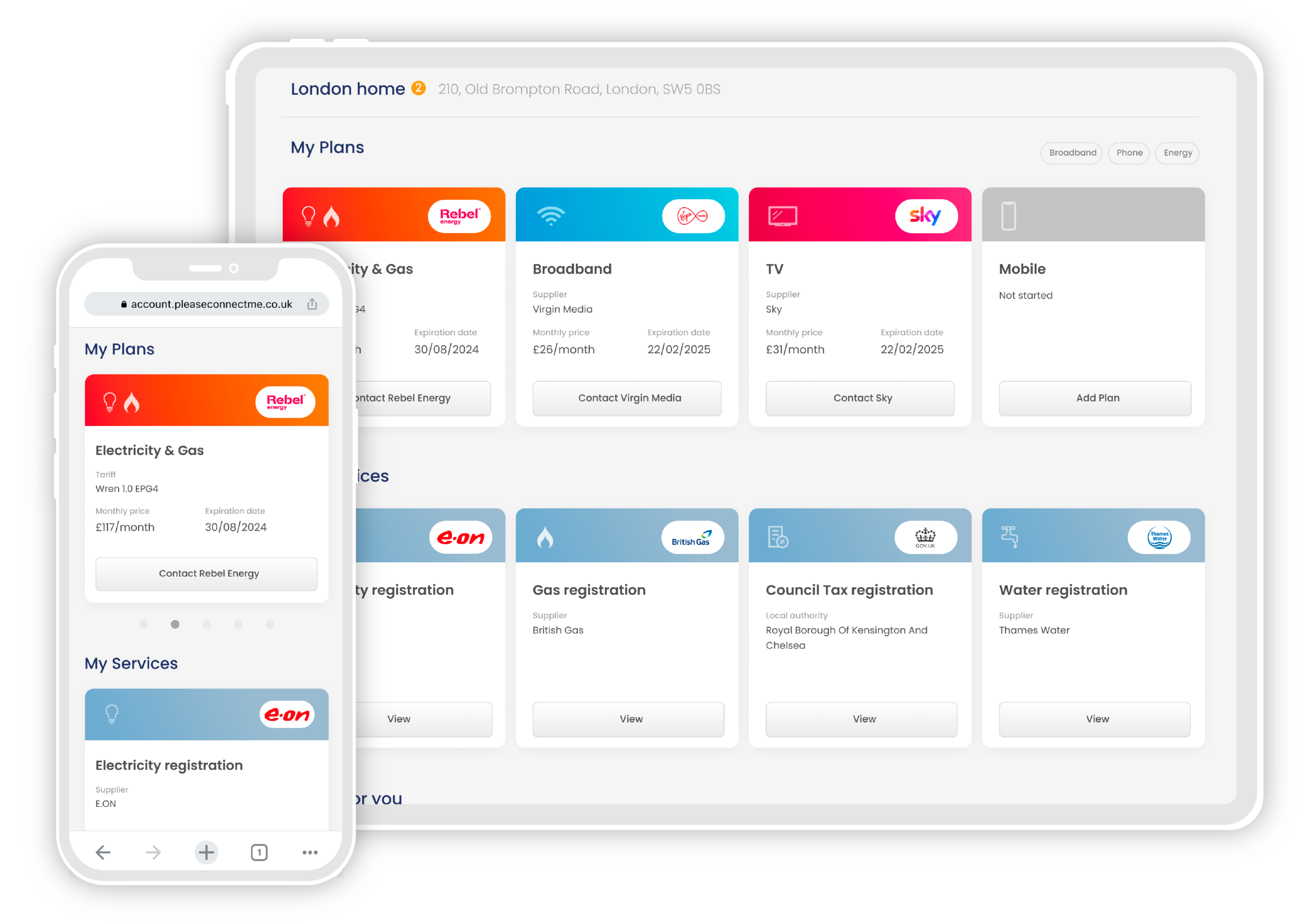

New to the UK? Manage all of your utility registrations with one free phone call