Just like clothing, food, energy and seemingly most things these days, the cost of insurance is climbing.

The Association of British Insurers (ABI) found that the average price of home buildings insurance rose 6% this year, up to £315 compared to £298 in 2022. The cost of a combined buildings and contents insurance policy also rose slightly more, by 6.7%.

Even among rising costs and tightening budgets, insurance is vital. That’s why we’ve compiled some of our top tips for saving on your buildings, contents or a combined insurance policy, so you don’t have to miss out on the cover you need.

Should I get contents insurance?

Around half of UK tenants have contents insurance. These policies cover their possessions in the event of a fire, flood or burglary. Depending on the policy, your insurer will either replace damaged items or pay out their value.

Households across the UK are searching for ways to cut back on bills, so it may seem counter-intuitive to set up a new policy, especially if you’ve never had contents insurance before. However, home contents insurance can be surprisingly affordable. Money Supermarket found the average household paid just £76 a year for their contents insurance in 2022, while the ABI calculated the figure at £139, or about £2.70 a week.

When looking at an insurance policy, consider not only if you can afford the policy but also if you can afford to replace your furniture, electronics, clothes and jewellery in the event of a disaster.

Save on your home insurance

Working from home

As you set up a new home insurance policy, you’ll be asked questions about how you use your property, including about working from home. However, according to the ABI, there’s no need to inform your insurer if you’re doing office or clerical work from your spare room.

Instead, you only need to inform your insurer if you keep stock at home or host business visitors at the property. You’ll usually pay additional fees to cover your business operations, or even be required to take out separate business insurance, so only mention that you work from home if it’s required.

Pay monthly

Many insurers will offer you a choice between a one-off annual payment and a recurring monthly plan, but be careful. Monthly plans usually include interest on your payments, meaning you’ll spend more over the year. If you can, pay for an entire year of cover up front and avoid the extra cost.

Save on your contents insurance

Know what you’re worth

When you first set up your policy, it’s important to give an accurate estimation of the value of your possessions. Estimate too high, and you’ll pay higher monthly premiums than you need to. Estimate too low and, if you need your insurance, you may receive a payout too low to replace your items.

A free contents value calculator like this one will save you time and make the process easier.

Accidental Damage?

Typically, a contents insurance policy won’t cover you in the event of accidental damage. If you don’t regularly take valuable items out of your home you can probably save by avoiding it, but if you’re clumsy or travel with valuable electronics or a bike it may well be worth it. While shopping for insurance, compare the price of adding accidental damage cover to your contents policy against taking out a separate policy for your gadgets or bike.

How to find a great deal on home insurance

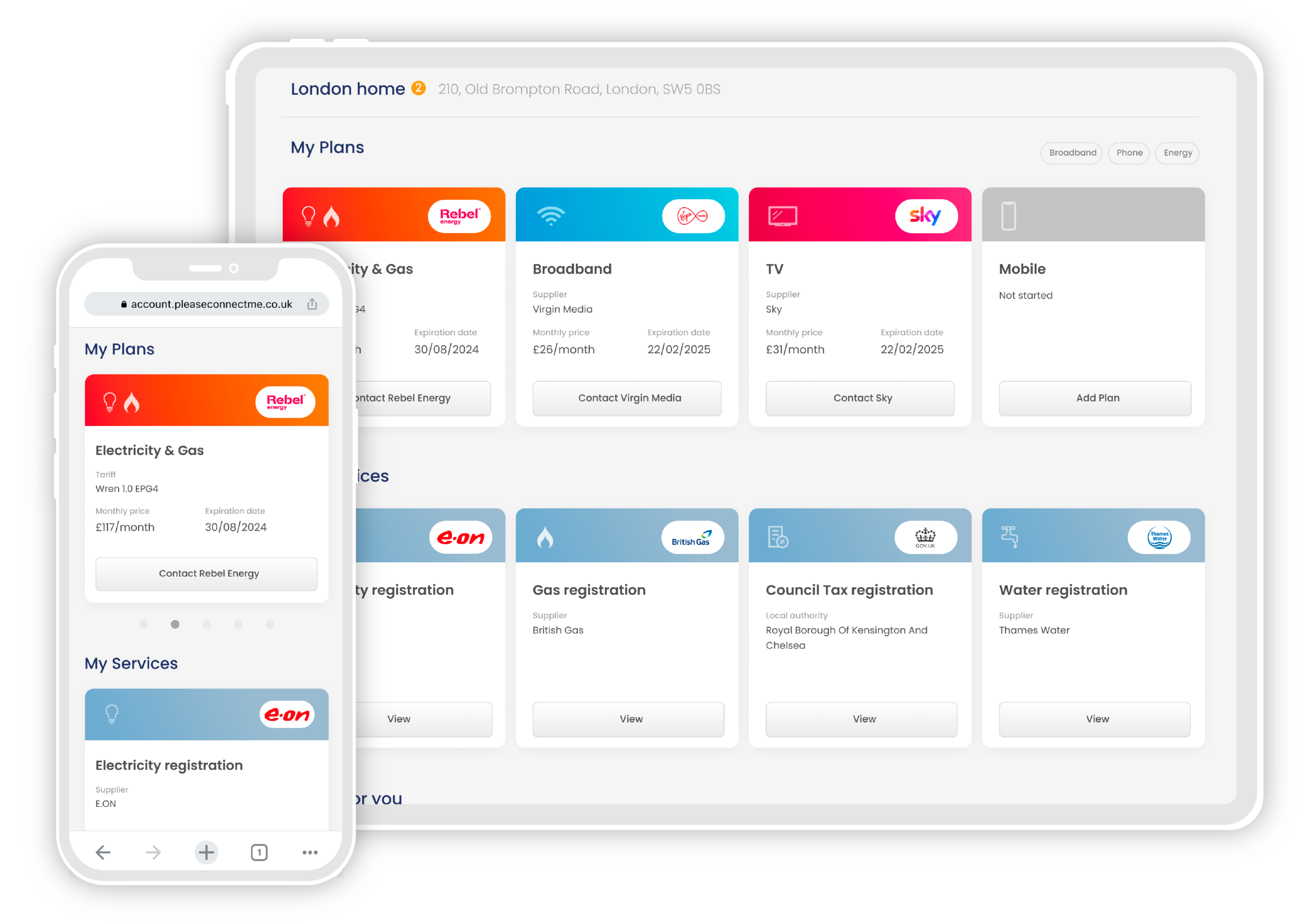

To help our clients get a great value insurance policy that covers everything they need we partner with top insurance brokers Safe and Secure.

Safe and Secure compare policies from the UK’s 5* Defaqto-rated insurers against each client’s individual requirements to find them the perfect cover. Want to learn more? Register with Please Connect Me today and get help with insurance and more from our friendly Connections Experts.

Learn more about property in the UK: