The cost of moving home is a huge concern for UK movers, especially as it can be so hard to estimate ahead of your move.

The home you’re moving from and to, the distance you are travelling and even the time of year can all affect the total cost of your move. Add in some of the unexpected bills that can pop up during your move and budgeting seems more and more impossible.

We’ve taken a look at the average cost of moving home in the UK in 2024 to help you estimate your costs. Plus, we’ve compiled some of our top tips for saving while you move house.

What is the average cost of moving home in the UK?

For tenants, the single biggest cost of moving home is removal. Hiring professionals to pack, load, transport and unpack your items is expensive, especially if you have a lot of large or delicate possessions.

Compare My Move gives the following average removal costs for a UK household in 2024, based on their user data.

|

Number of rooms |

Average removal costs (According to compare my move) |

|

One bedroom |

£507 |

|

Two Bedrooms |

£854 |

|

Three Bedrooms |

£1,304 |

|

Four bedrooms |

£1,752 |

The cost of your move will also depend on the area you are moving to and from, with higher property prices generally meaning higher moving costs. Compare My Move found the most expensive UK area to move to and within was the South East, with an average removal cost of between £1156 and £2103.

The cheapest area for removals was the North West, with a move costing between £690 and £1315 on average.

What can agents charge me for when I move?

One set of fees that used to add to the cost of moving home is those charged by estate agents or letting agents. However, the Tenants Fees Act of 2019 placed restrictions on what UK renters can be charged.

In 2024, your letting agent can only require you to pay:

- The rent

- Relevant utility costs

- A refundable deposit of up to five weeks’ rent (or six weeks if the annual rent is over £50,000)

- A refundable holding deposit of one week’s rent

- Charges for changing the tenancy agreement, capped at £50 or reasonably incurred expenses

- Payments for early termination of the tenancy if requested by the tenant

- Default fees for late rent payment

- Charges for lost keys and security devices

What’s the cost of selling and buying a home?

These removal costs cover the cost of moving out of and into a home, but what about buying and selling? Purchasing a property comes with a number of extra costs you will need to budget for, including:

Costs when buying a home

- Stamp Duty

- The building survey

- Conveyancing

- Mortgage Fees

- Mortgage Valuation Fees

- Homebuyers Protection Insurance

Costs when selling a home:

- Estate Agents Fees

- Conveyancing

- EPC (Energy Performance Certificate) assessment

- Removals

How can I save when I move home?

There are lots of things you can do as a mover to keep the cost of moving home down.

The first step is to prepare properly. The later you leave preparing for your move the less chance you’ll have to compare movers, find free or discounted supplies and handle things yourself. Use our free moving home checklist to prepare for your move and make sure you have everything covered.

The cost of packing supplies adds up quickly, but you can find free moving boxes in a number of places and save on supplies in other ways.

You can also cut moving costs by decluttering your home before the big day. Remember, the fewer items you have to move the less your removal company will charge.

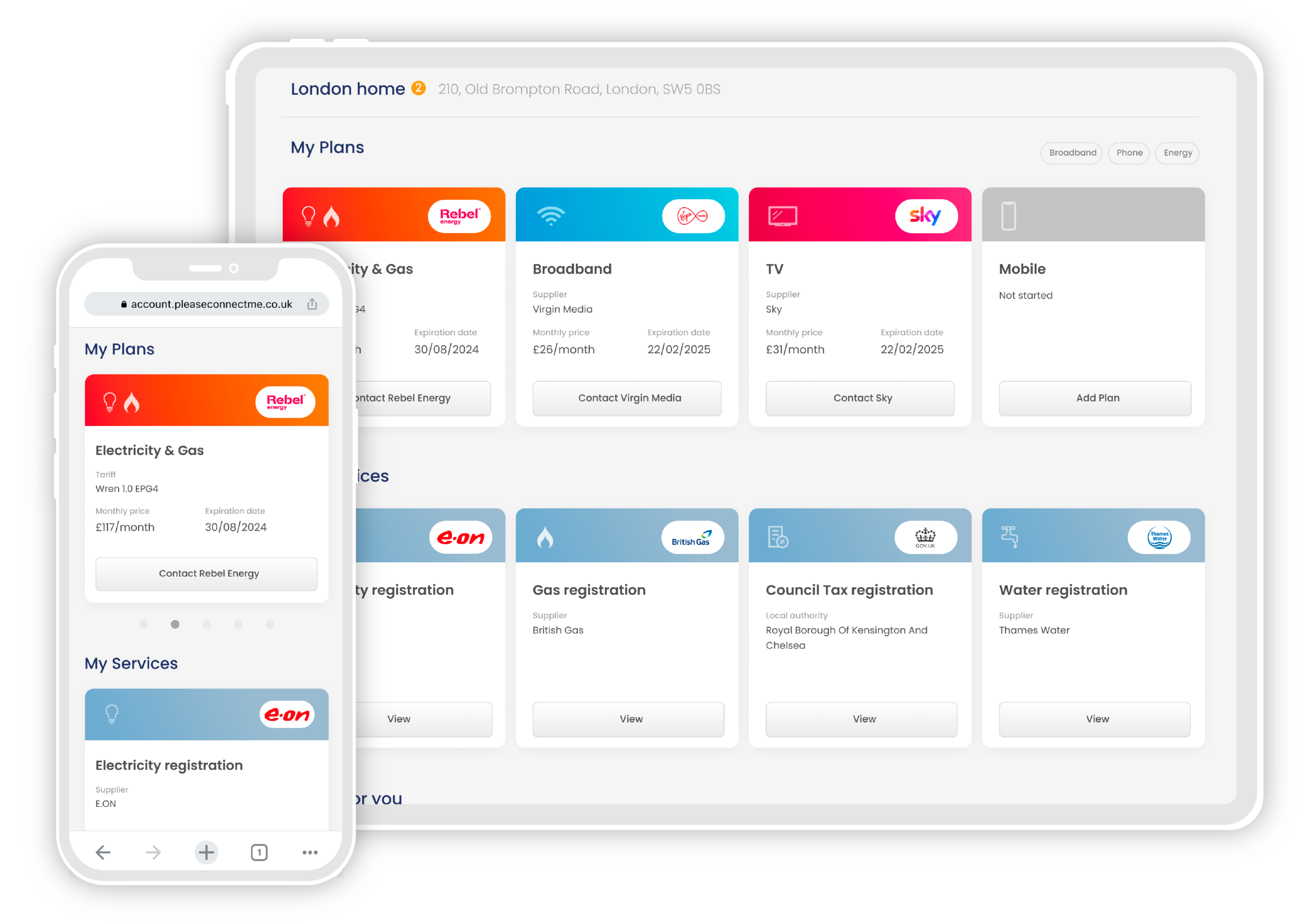

Last, but by no means least, make sure you’re not overpaying for utilities at your new home. Our free utility concierge service doesn’t just save movers an average of 7 hours of admin but also up to £397 a year on their utility bills. Sign up today and get your utilities sorted.